Using Mixed-Method to Explore Barriers and Cues to Action in Adoption of Green Banking Practices in Commercial Banks of Pakistan

Nazia Nazeer1*, Saher Ali1, Aliza Rind1

Department of Industrial Economics National University of Computer and Emerging Sciences-FAST, University of Malaya, Pakistan

- *Corresponding Author:

- Nazia Nazeer

Department of Industrial Economics National University of Computer and Emerging Sciences-FAST, University of Malaya, Pakistan

Tel: 03002888557

E-mail: nazia.nazeer@nu.edu.pk

Received Date: August 24, 2021; Accepted Date: November 12, 2021; Published Date: November 23, 2021

Citation: Nazeer N, Ali S, Rind A (2021) Using Mixed-Method to Explore Barriers and Cues to Action in Adoption of Green Banking Practices in Commercial Banks of Pakistan. J Environ Res. Vol: 5 No: 5.

Abstract

This study adopts a mixed methodology to explore barriers in adopting green banking practices in commercial banks of Pakistan. The quantitative part includes the primary data collection while the qualitative part includes focus groups discussion. The case has been made that combining qualitative and quantitative methods in a single study can help clarify several sides of the fact under examination, offering a more holistic understanding of it, and bring about some better-suggested policies. The results reveal that factor eco-friendly environment and awareness are more influential barriers as compared to other in adoption of green banking practices. For sustaining eco safety banking every bank of Pakistan should take innovative steps. Moreover, Pakistan banks should also implement green banking practices in their daily operations and they should also elaborate the financial and social advantages of sustainable banking to important customers of commercial banks.

Keywords

Green banking; Ecofriendly environment; Customers awareness; Policy guideline; Trust and loyalty; Security and privacy

Introduction

The environmental issue mostly discussed at this time is climate change. Despite several agreements under international law on the protection and cautious use of biological diversity, the natural resources exploitation and the destruction of species connected with it remain persistent. Interestingly, environmental issues related to the financial institution are not much debated earlier on. But now the concept of green finance and green banking has been adopted in various parts of the world and they encourage financial institutions particularly banks to reduce carbon footprints by introducing environment-friendly operations like to change policies related to giving loans and criteria to decrease industrial contamination [46,47]. Moreover, the banking industry is acquired a pivotal role in endorsing a socially accountable investment (SRI). Most banks are not considered emitters yet the banking sector is considering as the main user of resources like electricity and paper through a widespread web of branches and ATMs (automatic teller machines). Green banking refers to those guidelines and practices that create an image of banks as socially, economically, and environmentally accountable.

The implementation of green banking routines in developing nations, in particular, has received attention during 2012, when the establishment of Sustainable Banking Network (SBN) and the The banking industry act as an intermediate role between environmental protection and economic growth, for stimulating a sustainable environment and socially responsible investment(SRI). Therefore, the implementation of green banking practices in everyday operations, investment policies, financing strategies, and enhancement of CSR practices in emerging nations are much needed [26,27]. In this connection, in developing nations such as Pakistan, the adoption of green banking practices is somehow a new conception as compared to Bangladesh, China, and India. Though, few commercial banks in Pakistan have adopted green banking approaches in their routine operations through energy-efficient technologies for instance setting up energy-efficient products plus E-banking and software that permit precise automation of lighting and environmental control systems. Although, in response to Pakistan environmental protection act 1997, the state bank of Pakistan in 2017 has first-ever introduced green banking guidelines [48] adoption of green banking in Pakistan is a complex practice since it is still progressive and facing hindrances which are yet to be discovered. Hence, this study aims to investigate those barriers which hinder adopting green banking practices in the commercial banks of Pakistan by using a mixed-method approach. The case has been made that combining qualitative and quantitative methods in a single study can help clarify several sides of the fact under examination, offering a more holistic understanding of it, and bring about some better-suggested policies. The paper is planned as follows. Section 1 provides a literature review on Green banking; sections 2and 3 provide a methodology and data analysis and section 4 concluded the study.

Theoretical Context

Environmental management system comprises of those management measures that help the firm to find the approaches that facilitate them to inspect their environmental performance which not only develops their good reputation and goodwill but also increase their competitiveness [24]. In the case of developing nations, they face several hindrances such as inadequate state support, poor policy implementations, inaccuracy of information, sustainability of environmental, and high adoption cost [6]. In this context, financial organizations must have guidelines connected to environmental liability and risk to have strategies and policies that are protective [29-31]. In particular, the progress of Bangladesh in implementing green banking practices is notable [50,51]. The Bangladesh banking sector framed its guidelines and rules and regulations in the year 2011, for the adaption of green banking in the country and explained those barriers that aid in the adaption of green banking. Bangladesh Banks are making efforts to adopt cost-effective, innovative, and technology-driven approaches in banks. These approaches putting a dynamic modification in banking services, designing monetary policy, use of unconventional banking technologies, and practice of ICT (Information and Communication Technology) to spread out the financing facilities to customers. Likewise, many plans have already been taken on for instance digitalization of the financial sector, trade financing, aiming liquidity into productive financings that comprise of green banking and CSR activities, SMEs, and agriculture to guarantee their access to avail financial services [44,45]. Similarly, India is also implementing the green banking system because of the increasing shareholder values and rapidly changing the needs of customers (Harshad &Pithadia). The noticeable elements in implementing green banking practices in the above-mentioned countries are global warming, environmental risk, technological advancement, and customer awareness [11]. According to the Paris agreement 2015, 196 countries around the world have shown an agreement on this issue and emphasizes the usage of environmentally friendly products and services to minimize the negative impact on the environment. Banks should guarantee that they support green or sustainable financing and evade investing in those industries that are harmful to the environment plus should give loans or financing to those industries only aim to advance sustainability [34]. This way banks would consider as an ethical mediator that offers loans to the firms that ensure realistic vision towards environmental sustainability [3]. Indeed, banks have a most important role as well as obligations to improve state efforts to reduce carbon emission, to provide sustainable progress for the public and economy [32]. The main motive of the adoption of green banking involved promoting corporate social responsibility (CSR). Corporate social responsibility mainly emphases protecting the environment and the public, while banks are accountable to scrutinize the projects before investment either it is environmentally friendly or has dangerous impacts on the environment later on.

The banks should provide loans in case firms ensure that they followed environmental safety standards [4]. Being a developing country the adoption of green banking practices in Pakistan is somehow an emerging concept. The State Bank of Pakistan outlined green banking as progress to endorse environmentally friendly exercises that support banks and their clients to reduce carbon footprints (SBP, 2015). According to Green Banking Guidelines provided by of State Bank of Pakistan, green banking practices should reduce vulnerabilities of Banks or finance institutes for reducing the environmental-related risks and should transform the country’s economy to respond to harmful events, drifts, or turbulences related to climate. In comparison to Bangladesh and India, Pakistan still lags in implementing green banking routines. Pakistan has also observed many environmental problems, for instance, rapid increase in population, the unplanned utilization of proficient technologies, and badly managed waste management systems. But, to employ the guidelines provided by SBP, one should understand which characteristics and aspects of green banking should promote and whether these tools will help mitigate environmental threats to the lowest degree [8]. Green banking practices help in creating better environmental, corporate, and social advantages, which leads to raising competitive advantage using customer trust and loyalty. The adoption of green banking practices supports customer retention, which may enhance the best environment [28]. It also aids in developing a process to gain customers' interest through inciting the green banking practices approach instead of orthodox approaches. However, today s world is much more concerned about sustainable strategies, henceforth there is a need that banks should adopt those strategies which help them to be competitive in the global world [41-43]. Similarly, few studies show that the adoption of green banking practices is influenced by the problems for instance absence of awareness, data security, face to face transactions, less information about online transferring approaches, value creation, to use social plus environment concerns, and other technical issues [14]. The banks must aware of the different features which directly affecting the customers to adopt green products [25]. Interestingly, Ko discovered that not only customers but banks also support “go green†practices. Besides, the study also observes that the customers are willing to connect with environment accepted products and the businesses aiming for both customers and society which include customers trust and loyalty, attitude, and getting customers long term satisfaction. In this connection, the customer s trust level in a business appeared to have a pivotal impact on customer’s loyalty towards the business [10]. In performance, the role of the banking sector is of great importance in growing economies to adopt and enable environmentally friendly corporate practices, through recognizing the significance of social, corporate, and environmental measures [35]. Developing nations are facing barriers such as lack of insufficient (state support, absence of practical implementation of policies, absence of awareness (particularly customer’s awareness), and high adoption cost [36-40]. The formulation of green banking policies contains micro and macro-prudential policy, market-making policy along credit allocation policy [15,16]. Furthermore, the existing collected works on the adoption of green banking practices caused in absence of thoughtfulness amongst industry and policymakers in mitigating environmental hazards and boosting less-carbon emanation economy [7]. The execution of environment-related policies is not effective as available data and methods to assess between advanced and emerging nations to compare environment practices are scarce. However, few studies examine the execution of green credit policy, however, these investigations are inadequate and reveal diverse outcomes, mostly express the unsuccessfulness of policy implementation [1]. Undoubtedly, since 2017 different strategies are introduced to stimulate environmentally friendly practices with a consideration of effectiveness in reducing the CO2 footprint in the banking sector, generally paying online bills services, online banking, and other monetary transactions [8].

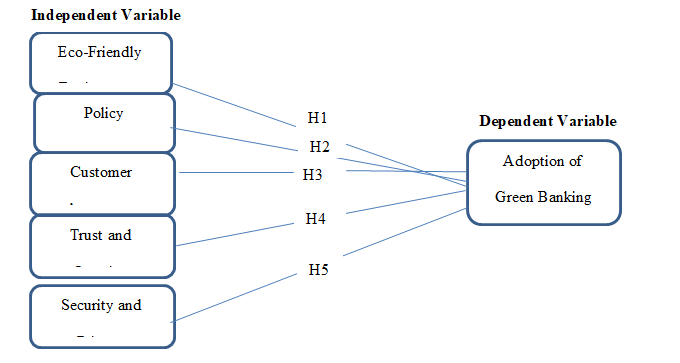

The above discussion clarifies that the existing literature is not sufficient to address the concept of adoption of green banking practices, particularly in Pakistan.Hence, this study pursues to carry fresh evidence to fill the gap in the literature by using a mixed-method approach and gather data through qualitative and quantitative methods from commercial banks of Pakistan. Figure 1 shows the conceptual framework along with the hypotheses formulated. As represented in the framework and observed critically before the literature review, the barriers do exist in the adoption of green banking practices and these barriers may differ in different nations. This study proposed the adoption of green banking practices as a dependent variable and an Eco-Friendly environment, policy guidelines, customer’s awareness, trust and loyalty, and security and privacy as an independent variable. Therefore, testing the following hypotheses for commercial banks of Pakistan will help us to understand those barriers that hinder adopting green banking practices.

H1

There is a significant association between an eco-friendly environment and the adoption of green banking practices.

H2

There is a significant association between policy guidelines and the adoption of green banking practices.

H3

There is a significant association between Customer awareness and adoption of green banking practices.

H4

There is a significant association between trust and loyalty and the adoption of green banking practices.

H5

There is a significant association between security and privacy and the adoption of green banking practices.

Methodology

This study used a mixed-method approach in which the quantitative part precedes the qualitative part which reflects the study’s overall objective [12,13]. The purpose of using the mixed method, earlier introduced by Greene, Caracelli, and Graham, is to increase the significance, enhance, elaborate, and interpretability of the empirical outcomes of a quantitative study [22,23]. The quantitative phase used in this study is started with a pilot study which later makes the grounds for the qualitative investigation. The data collection lasted from April to October 2020. The questionnaire is developed after an extensive literature review and sent to selected officials from the commercial banks. After receiving their feedback and incorporating their suggestions due to Covid19 restrictions online questionnaires through random sampling were then sent to the respondents. According to the State bank of Pakistan, the total numbers of banks are 34 with a total of 14,119 branches across the country. Hence, the research sample consists of 250 respondents including managers, assistant managers, and long-term/permanent customers. In total, 160 questionnaires with closed-ended questions were completed and returned. The respondent rate is accepted as Arumugam and Chirute used a 160 sample size for similar research [2]. The other reason for this small sample size is green banking is not fully implemented in Pakistan rather the banks are in a transitional phase towards the adoption of green banking practices. The data collected were analyzed based on mean, standard deviation, percentages, and frequencies using SPSS. The questionnaire carrying missing data or incomplete answers was not considered in the analysis. Table 1 below shows the respondent's rate of the study.

| Respondents | Education (Minimum) | Experience (Minimum) |

Response Rate |

|---|---|---|---|

| Managers | MBA, Masters | More than 7-10years | 35% |

| Assistant Managers | Graduate | More than 3-5 years | 40% |

| Customers | Basic Schooling (7%) Matric & Intermediate (9%) Graduate (5%) Masters and above (4%) |

25% |

Source: Authors Calculations

Table1: Results of Response Rate.

To check the reliability of the questionnaire Cronbach’s alpha was used and the value came out to be 0.915 which shows high reliability. The data were analyzed with the orthodox practice of factor analysis frequency tables, histograms, and inter-item correlations using SPSS. KMO (0.834) points out that the data has a strong correlation between variables and Bartlett’s test significance value (0.000) is less than 0.05 which indicates that the correlation matrix is not an identity matrix.

Further, the communalities test was also run which indicated that all the questions were fitting well into the analysis with their communality value being greater than 0.5 no question was removed and further analysis was conducted. The initial value for all variables under communality is equal to 1 as the unities were put in the diagonal of the correlation matrix. The eigenvalue of factor 1 is 8.377 showed 38.079% variance intensity. All 22 factors have 100% variance intensity. Consequently, factor 1 has 38.079% of the variance of the adoption of green banking policy, and factor 2 has 10.073% of the variance and so forth. While extraction sums of squared loadings indicate those variables that are retained in this research. The analysis shows that 5 factors are retained with a total of 70.490% of the overall variance. Also, those factors are retained which shows an eigenvalue of more than one. Hence for this particular study, we are extracting 6 factors based on the following justifications:

• Only extract those factors whose eigenvalue shows more than one and 6 factors have that score.

• The cumulative variance of six factors extracting is 70.490% which indicate a satisfactory level

• Consider the Scree plot that also gives an idea about how many factors should be extracted.

The result of an un-rotated factor matrix indicates the relationship between the components and the distinct relationships of all components. One main problem of doing an un-rotated factor matrix is that one variable is at times related to numerous factors which creates problems in interpretation. Here Eco-friendly environment is allied with factor 1 and customer‘s awareness with factor 2 and policy guidelines with factor 3, trust and loyalty with factor 4 security and privacy with factor 5, and adoption of green banking with Factor 6. Therefore, a rotated factor matrix is important as it will help to resolve the interpretation problem. The results of the rotated factor matrix, make it possible to interpret the factors extracted with the percentage of variance explained plus the variables to be involved in every factor. These items and their descriptive statistics are presented in Appendix A.

For the qualitative part, a focus group methodology was selected for this study. The focus group methodology is suitable for this research as it allows all the participants to bring- up and converse critical issues, hence ensure the collection of abundant and multifaceted data based on the participants’ own experiences [5]. The focus group consisted the of four to six representatives from the commercial banks. Due to Covid -19 restrain the online link was provided to all the participants before the discussion. The cluster sampling approach was used for qualitative analysis. Cluster analysis is appropriate for this research as it allows the researcher to classify relatively homogeneous subgroups of representatives but with distinguished characteristics of the participants that are designation, experience, and education. Twenty participants were selected for 4 focus groups. All the sessions were moderated by three of the authors. The sessions were maximum of one hour-long online and recorded. The moderators take notes during the sessions. The data were then cautiously examined, coded, and analyzed through methods consistent in conjunction with qualitative research [9]. To ensure secrecy of the participant’s code names were allotted. All the recorded sessions were typed by authors for rigor analysis. To summarize the comments, common themes and distinctive themes were used. Common themes refer to those responses that arose by the majority of the groups and distinctive themes refer to those responses that arose by only 2 groups. Lastly, the authors have reviewed each other’s transcripts to verify the categories that stemmed from the data. Around thirty to thirty-five single-spaced pages of transcripts were checked by each researcher for accurateness.

Results and Discussion

The following section will discuss the statistical results of the study.

Research variables

| Variables | Measures |

|---|---|

| Green banking adoption | Encourage financial institutions particularly banks to reduce carbon footprints by introducing environment friendly operations like to change policies related to giving loans and criteria to decrease industrial contamination [46,7]. |

| Ecofriendly environment | Activities that contribute to make environment green and healthy are ecofriendly activities. Use of online banking or paperless banking, preventive measures to reduce waste and pollution come under ecofriendly activities. online transitions, including payments of bills, must be encourage which reduces the carbon footprints from banking activities [33]. |

| Policy Guideline | It is a statement where the company mentions its commitment responsibilities related to the sustainability of the environment. Formulation of green banking policies contain micro and macro-prudential policy, market- making policy along with credit allocation policy [49]. |

| Customers Awareness | Various features which influence the customers to adoption of green banking products and practices [25,14]. |

| Trust and Loyalty | The level of trust customers have in a company is considered to have a significant influence on the loyalty of the customer to the company [17]. |

| Security and Privacy | To be financially secure is important for customers. In online banking there is online funds transfer and other transaction can be made and customers are always concern about the privacy and security of their transaction [14]. |

Table2: Variables used and their measures.

Correlation and Regression

The study considers one dependent variable: adoption of green banking and five independent variables: eco-friendly environment, policy guideline, customer ‘s awareness, trust and loyalty, and Security and privacy. Hence the following equation is formed:

Regression Equation Regression Equation

Y = B0 + B1X1 + B2X2 + B3X3 + B4X4 + B5X5 Equation……1

Whereas

| Y= Adoption of Green Banking | B0= Constant |

| X1= Ecofriendly environment | B1= coefficient of ecofriendly environment |

| X2= Policy guideline | B2= coefficient of policy guideline |

| X3= Customer ‘s Awareness | B3= coefficient of Customer ‘s Awareness |

| X4= Trust and Loyalty | B4= coefficient of Trust and Loyalty |

| X5= Security and privacy | B5= coefficient of Security and privacy |

| Eco-friendly Environment | Adoption of Green Banking | ||

|---|---|---|---|

| Eco-friendly Environment | Pearson Correlation | 1 | .530** |

| Sig. (2-tailed) | .000 | ||

| N | 160 | 160 | |

| Adoption of Green Banking | Pearson Correlation | .530** | 1 |

| Sig. (2-tailed) | .000 | ||

| N | 160 | 160 | |

| **. Correlation is significant at the 0.01 level (2-tailed). | |||

Table 3: Correlations test of Ecofriendly Environment and Green Banking adoption.

It can be observed from Table 3 that by the correlation value being equal to 0.53 that indicates that Eco-friendly Environment is positively and strongly related to the Adoption of Green Banking and the p value being less than level of significant (0.01) which tell that both variables are statistically significant. Hence the study accepts the first hypothesis.

| Adoption of Green Banking | Policy Guideline | ||

|---|---|---|---|

| Adoption of Green Banking | Pearson Correlation | 1 | .435** |

| Sig. (2-tailed) | .000 | ||

| N | 160 | 160 | |

| Policy Guideline | Pearson Correlation | .435** | 1 |

| Sig. (2-tailed) | .000 | ||

| N | 160 | 160 | |

| **. Correlation is significant at the 0.01 level (2-tailed). | |||

Table 4: Correlations test of Adoption of Green Banking and Policy guideline.

Correlation analysis in Table 4 shows a moderate and positive relationship (0.435) between the guidance of Policies and in Adopting the Green way of Banking and the p value shows that both variables are statistically significant. Hence the study accepts the second hypothesis.

| Adoption of Green Banking | Customer ‘s Awareness | ||

|---|---|---|---|

| Adoption of Green Banking | Pearson Correlation | 1 | .510** |

| Sig. (2-tailed) | .000 | ||

| N | 160 | 160 | |

| Customer ‘s Awareness | Pearson Correlation | .510** | 1 |

| Sig. (2-tailed) | .000 | ||

| N | 160 | 160 | |

| **. Correlation is significant at the 0.01 level (2-tailed). | |||

Table 5: Correlations test of Adoption of Green Banking and Customer ‘s Awareness.

In Table 5 encouraging and robust association (0.510) between Customer ‘s Awareness and Adoption of Green Banking as well as the p value is less than the level of significance which further confirms that both variables are significant statistically. Hence the study accepts the third hypothesis.

| Adoption of Green Banking | Trust and Loyalty | ||

|---|---|---|---|

| Adoption of Green Banking | Pearson Correlation | 1 | .402** |

| Sig. (2-tailed) | .000 | ||

| N | 160 | 160 | |

| Trust and Loyalty | Pearson Correlation | .402** | 1 |

| Sig. (2-tailed) | .000 | ||

| N | 160 | 160 | |

| **. Correlation is significant at the 0.01 level (2-tailed). | |||

Table 6: Correlations test of Adoption of Green Banking and Trust and Loyalty.

| Adoption of Green Banking | Customer ‘s Awareness | ||

|---|---|---|---|

| Adoption of Green Banking | Pearson Correlation | 1 | .510** |

| Sig. (2-tailed) | .000 | ||

| N | 160 | 160 | |

| Customer ‘s Awareness | Pearson Correlation | .510** | 1 |

| Sig. (2-tailed) | .000 | ||

| N | 160 | 160 | |

| **. Correlation is significant at the 0.01 level (2-tailed). | |||

Table 7: Correlations test of Adoption of Green Banking and Security and Privacy.

In Table 6 the correlation results show positive and somewhat moderate relationship (0.402) between Trust and Loyalty and Adoption of Green Banking and the p value is 0.000 which is less than the level of significance which approves that the relationship between variables is statistically significant. Hence the study accepts the forth hypothesis. The correlation results in Table 7 which is equal to 0.441 shows positive and moderate association between Security and Privacy and Adoption of Green Banking and the p value or Sig. (2-tailed) is 0.000 which is less than the level of significance which supports that the association between variables is statistically significant. Hence the study accepts the fifth hypothesis.

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

|---|---|---|---|---|---|---|

| 1 | Regression | 32.588 | 5 | 6.518 | 19.450 | .000b |

| Residual | 51.605 | 154 | .335 | |||

| Total | 84.194 | 159 | ||||

| a. Dependent Variable: Adoption of Green Banking | ||||||

| b. Predictors: (Constant), Security and Privacy, Ecofriendly Environment, Policy Guideline, Trust and Loyalty, Customer ‘s Awareness | ||||||

Table 8: Results of ANOVAa.

According to the Table 8 the P value result (0.000) which is less than the level of significance of 0.05, all of the independent variables consistently estimate the Adoption of Green banking.

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||

|---|---|---|---|---|---|---|

| B | Std. Error | Beta | ||||

| 1 | (Constant) | .945 | .381 | 2.476 | .014 | |

| Ecofriendly Environment | .497 | .108 | .375 | 4.597 | .000 | |

| Policy Guideline | .042 | .107 | .034 | .393 | .695 | |

| Customer ‘s Awareness | .214 | .095 | .231 | 2.245 | .026 | |

| Trust and Loyalty | -.054 | .083 | -.059 | -.651 | .516 | |

| Security and Privacy | .167 | .085 | .181 | 1.969 | .051 | |

| a. Dependent Variable: Adoption of Green Banking | ||||||

Table 9: Coefficientsa.

Table 9 shows the coefficients of the regression equation for each variable furthermore by analyzing the results of P value(0.000) and Beta(0.375) of ecofriendly environment of the result it can be confirmed that the relationship between Ecofriendly environment and adoption of green banking is statistically significant, positive and stronger than the other independent variables and which indicates that ecofriendly environment is valid predictor of Green banking’s adoption in commercial banks of Pakistan. Further by looking at the p value (.026) and beta (.231) of Customer‘s Awareness a positive and statistically significant relationship can be observed. For Security and privacy, the p value of 0.051and Beta of .181 we can confirm that there is also association however it is quite weaker than the Ecofriendly environment and Customer‘s Awareness. Furthermore, for the variables Policy guideline and Trust and loyalty the p value being greater than thea=0.05 and beta values being nearer to 0 we come to conclusion that these two are found to be predictors for the adoption of green banking in Pakistan. Lastly the following regression equation is formed:

Y = .945 + .497X1 + .042X2 + .214X3 + -.054X4 + .167X5 Equation…...2

| Q1 | What is the biggest change in banking services since the adoption of green banking practices? |

| Q2 | What do you believe is why the banks in Pakistan have not fully adopted green banking practices? In your view what are the main causes? |

| Q3 | What is the greatest concern of customers related to green banking practices? |

| Q4 | What do you think would be helpful for states and banks to adopt green banking practices? |

Table 10: Below shows the example of review questions used to guide focus group discussion.

The results of qualitative research reveal that all the participants unanimously agreed that eco-friendly practices are the need of the time. To achieve this, online transitions, including payments of bills, must be encouraged which reduces the carbon footprints from banking activities. Few banks in Pakistan have taken an initiative such as using solar power as an alternate source of electricity in rural and remote branches and install solar-powered ATMs. Many participants also mentioned that banks should focus on environmental policy guidelines which serve as guiding principles for best practices instituting an economic and competitive businesses environment for banks. All the participants agreed that policy guidelines must possess well defines procedures that help customers, investors, and authorities to understand the importance and impact of green banking practices on their business. Furthermore, the policy guideline must provide insight to banks to identify efficient approaches for carbon markets, green mortgages, and energy-efficient processes, etc. In this context, focus group participants agreed on drafting a fully developed structure for environment projects which helps the banks to appear as an environmentally cognizant institute on an international level and also enables them in constructing favorable relations with the state agencies committed to implementing environmental guidelines. All the participants invited in the focus group discussion agreed that most of the customers are unaware of green banking practices. Interestingly, all the participants agreed that the age factor is one of the most affecting variables in developing awareness among customer’s understanding towards adoption of green banking practices. These were common across all age groups regardless of their experience in availing of banking services. One of the reasons highlighted by the participants was the country’s poor education system. The members also agreed that banks should develop awareness programs, particularly in the national language to spread the advantages of using green banking practices such as the use of the internet and mobile banking. Also, these awareness programs must include meetings with customers to identify their concerns related to the adoption of green banking practices. For the successful execution of these awareness programs, banks must provide some recompenses that will encourage customers to participate. Most of the participants agreed that a customer’s trust that his or her deposit is safe with the banks leads to customer satisfaction which is an essential step towards loyalty formulation. To establish customer trust and loyalty and to sustain it for a longer time, the banks should focus on relationship marketing strategies that help to influence customers’ perceptions of green banking practices. Also, loyalty is not just formed by basic services offered, but it also depends on different activities like advertising about the introduction of new initiatives related to green banking services and enhancing public relations. Most of the participants agreed that now a day’s customers are more concerned about the security and privacy of their private information particularly while using online transactions. The most common threat faced by the customers is illegal data modification and illicit use of the internet, in case the customer is not fully aware of how to use it. Precautionary measures must be put up to evade any this kind of negative impression and must include all of the personnel in the bank, especially frontline employees responsible for customer interaction management.

Conclusion

This research work provides a mixed-method approach to examine the barriers influencing the adoption of green banking practices in commercial banks of Pakistan. Especially, barriers influencing the adoption of green banking are firstly measured using a survey questionnaire and statistical results establish the basis for creating a thematic guide and focus group discussion to further look at the aspects of these barriers. The results reveal that eco-friendly environment, policy guideline, customer ‘s awareness, trust and loyalty, and security and privacy is an important factor in the adoption of green banking. But the factor of eco-friendly environment and awareness was found to be more influential as compared to other barriers to the adoption of green banking practices in commercial banks of Pakistan. The qualitative results also support the results of quantitative results. The result of the focus group discussion also shows that customer awareness and -eco-friendly practices are the most important barriers influencing the adoption of green banking practices in the banks. Therefore, the banking sector needs to use a hyperactive and intelligent system in dealing with a sustainable future. To become stronger, banks should apply principles and responsibility to their business model. Recently some developments in Green banking is seen in Pakistan as Faisal bank and Dubai Islamic bank implemented Green banks in Pakistan and JS bank has built their green office to create awareness among its employees regarding the environment. As there is a rapid change in environmental factors Pakistan banks may experience strong competition in the global market. State bank of Pakistan must observe the inspection of green banking sops by all banks and help banks in taking action on its guidelines. For sustaining eco safety banking every bank of Pakistan should take innovative steps. Moreover, Pakistan banks should also implement green banking practices in their daily operations and they should also elaborate the financial and social advantages of sustainable banking to important customers of commercial banks. There are many avenues that further research could explore. Different methodologies with different measures can be applied in the future for analyzing the reasons affecting the adoption of green banking in Pakistan. The produced data are real because the participants reciprocally in?uence one another in the same way as happens in real life. Additionally, due to the respondents’ lack of anonymity, some of them may feel intimidated and avoid openly expressing their thoughts [18-21]. Hence, in-depth face-to-face interviews would also help to understand the various reasons for the adoption of green banking practices in commercial banks of Pakistan.

References

- Aizawa, M., & Yang, C. (2010). Green credit, green stimulus, green revolution? China‟s mobilization of banks for environmental cleanup, Journal of environment and development, 19(2), 119-144

- Arumugam, D., & Chirute, T. (2018). Factors determining the adoption of green banking amongst commercial banks in Malaysia. Electronic Journal of Business & Management, 50-62.

- Azizan, S. A. M., & Suki, N. M. (2014). The potential for greener consumption: Some insights from Malaysia.Mediterranean Journal of Social Sciences,5(16), 11-11.

- Bihari, S. C., & Pandey, B. (2015). Green banking in India.Journal of Economics and International Finance,7(1), 1-17.

- Bloor, M., Frankland, J., Thomas, M. & Robson, K. (2001) Focus groups in social research (London, Sage)

- Bose, I., & Gupta, V. (2017). Green HRM practices in private health care & banking sectors in India.Indian Journal of Industrial Relations,53(1), 48-58.

- Bowman, M. (2010). The role of the banking industry in facilitating climate change mitigation and the transition to a low-carbon global economy.Environment and Planning Law Journal,27, 448.

- Bukhari, S. A. A., Hashim, F., & Amran, A. (2020). Green Banking: A road map for adoption.International Journal of Ethics and Systems.

- Casey, M. A., & Krueger, R. A. (1994). Focus group interviewing. InMeasurement of food preferences(pp. 77-96). Springer, Boston, MA.

- Chen, Y. S., Chang, C. H., Yeh, S. L., & Cheng, H. I. (2015). Green shared vision and green creativity: The mediation roles of green mindfulness and green self-efficacy.Quality & Quantity,49(3), 1169-1184.

- Choudhury, T. T., Salim, M., Al Bashir, M., & Saha, P. (2013). Influence of stakeholders in developing green banking products in Bangladesh.Research Journal of Finance and Accounting, 67-77.

- Creswell, J. W. (1999). Mixed-method research: Introduction and application. InHandbook of educational policy(pp. 455-472). Academic Press.

- Creswell, J. W. (2003). A framework for design.Research design: Qualitative, quantitative, and mixed methods approaches, 9-11.

- Dhamija, A., & Sahni, D. (2018). Green Banking: Perception and Willingness of Customers to Adapt Green Banking.International Journal of Financial Management,7(2), 1-8.

- Dikau, S., & Volz, U. (2018). Central banking, climate change and green finance.

- Estabrooks, C. A., Field, P. A., & Morse, J. M. (1994). Aggregating qualitative findings: an approach to theory development.Qualitative Health Research,4(4), 503-511.

- Flavián, C., GuinalÃÂu, M., & Gurrea, R. (2006). The role played by perceived usability, satisfaction and consumer trust on website loyalty.Information & management,43(1), 1-14.

- Flores, J. G., & Alonso, C. G. (1995). Using focus groups in educational research: Exploring teachers' perspectives on educational change.Evaluation review.

- Frechtling, J. A., & Sharp, L. M. (Eds.). (1997).User-friendly handbook for mixed method evaluations. Diane Publishing.

- Gobinda Deka, 2015, Green banking practices: Astudy on environmental strategies of Bank with Special Reference to State Bank of India , Vol VI, Issue 3, Indian Journal of Commerce & Management Studies

- Goyal, K., & Joshi, V. (2011). A study of social and ethical issues in banking industry. International Journal of Economics and Research, 2(5), 49-57.

- Greene, J. C., Caracelli, V. J., & Graham, W. F. (1989). Toward a conceptual framework for mixed-method evaluation designs.Educational evaluation and policy analysis,11(3), 255-274.

- Harshad Patel and Dr. Vijay Pithadia (2013), Impact of Globalization of Indian Banking Sector, International Monthly Refereed Journal of Research In Management & Technology, ISSN – 2320-0073 Volume II, February’13

- Hart, O. (1995).Firms, contracts, and financial structure. Clarendon press.

- Herath, H. M. A. K., & Herath, H. M. S. P. (2019). Impact of Green banking initiatives on customer satisfaction: A conceptual model of customer satisfaction on green banking.J. Bus. Manag,21, 24-35.

- Ikram, M., Sroufe, R., Mohsin, M., Solangi, Y. A., Shah, S. Z. A., & Shahzad, F. (2019). Does CSR influence firm performance? A longitudinal study of SME sectors of Pakistan.Journal of Global Responsibility.

- International Finance Corporation (2019)

- Iqbal, M., Nisha, N., Rifat, A., & Panda, P. (2018). Exploring client perceptions and intentions in emerging economies: The case of green banking technology.International Journal of Asian Business and Information Management (IJABIM),9(3), 14-34.

- Jeucken, M. (2010).Sustainable finance and banking: The financial sector and the future of the planet. Routledge.

- Jin, D., & Mengqi, N. (2011). The paradox of green credit in China.Energy Procedia,5, 1979-1986.

- KINGRY, M. J., Tiedje, L. B., & FRIEDMAN, L. L. (1990). Focus groups: a research technique for nursing.Nursing research,39(2), 124-125.

- Mani, A. (2011). Green banking through green lending.Institute of Business Management and Technology, Bangalore.

- Ko, M., Mancha, R., Beebe, N., & Yoon, H. S. (2012). Customers’ personality, their perceptions, and green concern on internet banking use.Journal of Information Technology Management,23(4), 21-32.

- Masukujjaman, M., & Aktar, S. (2013). Green banking in Bangladesh: A commitment towards the global initiatives.Journal of Business and Technology (Dhaka),8(1-2), 17-40.

- Masukujjaman, M., Siwar, C., Alam, A. S. A., Bashawir, A., & Er, A. (2016). Economy-environment nexus for development: is Bangladesh on the right track?.International Journal of Advanced and Applied Sciences,3(2), 25-29.

- Masukujjaman, M., Siwar, C., Mahmud, M. R., & Alam, S. S. (2017). Bankers’ perception of Green Banking: Learning from the experience of Islamic banks in Bangladesh.Geografia-Malaysian Journal of Society and Space,12(2).

- Miah, M. D., Rahman, S. M., & Mamoon, M. (2020). Green banking: the case of commercial banking sector in Oman.Environment Development and Sustainability, 1-17.

- Miles, M. B., & Huberman, A. M. (1984). Drawing valid meaning from qualitative data: Toward a shared craft.Educational researcher,13(5), 20-30.

- Miles, M. P., & Covin, J. G. (2000). Environmental marketing: A source of reputational, competitive, and financial advantage.Journal of business ethics,23(3), 299-311.

- Morgan, D. L. (1998). Practical strategies for combining qualitative and quantitative methods: Applications to health research.Qualitative health research,8(3), 362-376.

- Nath, V, Nayak, N, & Goel, A 2014, „Green Banking Practices – A Review‟, International Journal of Research in Business Management (IMPACT Journal), vol. 2, no. 4, pp. 45-62.

- Porter, M. E., & Van der Linde, C. (1995). Toward a new conception of the environment-competitiveness relationship.Journal of economic perspectives,9(4), 97-118.

- Raad Mozib Lalon. 2015. Green banking: Going green. International Journal of Economics, Finance and Management Sciences. Vol. 3(1): 34-42.

- Rahman, M., Ahsan, M., Hossain, M., & Hoq, M. (2013). Green banking prospects in Bangladesh.Ali and Hossain, Md. Motaher and Hoq, Meem, Green Banking Prospects in Bangladesh (June 2, 2013). Asian Business Review,2(2).

- Ren, X., Shao, Q., & Zhong, R. (2020). Nexus between green finance, non-fossil energy use, and carbon intensity: Empirical evidence from China based on a vector error correction model.Journal of Cleaner Production,277, 122844.

- Sahoo, P., & Nayak, B. P. (2007). Green banking in India.The Indian Economic Journal,55(3), 82-98.

- Spradley, J. P. (2016).The ethnographic interview. Waveland Press.

- State bank of Pakistan(2017).

- Thombre, KA 2011, „The New Face of Banking‟, Green Banking. Research Paper – Commerce, vol. 1, no. 2, pp. 1- 4

- UNEP FI, & BEI. (2014). Stability and sustainability in banking reform: Are environmental risks missing in Basel III? United Nations Environment Programme Finance Initiative and Banking Environment Initiative

- van Esterik-Plasmeijer, P. W., & Van Raaij, W. F. (2017). Banking system trust, bank trust, and bank loyalty.International Journal of Bank Marketing.

Open Access Journals

- Aquaculture & Veterinary Science

- Chemistry & Chemical Sciences

- Clinical Sciences

- Engineering

- General Science

- Genetics & Molecular Biology

- Health Care & Nursing

- Immunology & Microbiology

- Materials Science

- Mathematics & Physics

- Medical Sciences

- Neurology & Psychiatry

- Oncology & Cancer Science

- Pharmaceutical Sciences