Refining Used Lube Oil and Industrial Gross Domestic Product Nexus in Tunisia Company of Lubricants

Department of Economics and Management (RUDE), University of Sfax, Tunisia

- *Corresponding Author:

- Dr. Lamia Ben Amor

Department of Economics and

Management, University of Sfax, Airport

Road University Km 0.5 BP 1169 .3029 Sfax,

Tunisia.

Tel: +966559128932

E-mail: lamiabenamor@yahoo.fr

Received date: January 23, 2019; Accepted date: February 26, 2019; Published date: March 05, 2019

Citation: Amor LB, Hammami S (2019) Refining Used Lube Oil and Industrial Gross Domestic Product Nexus in Tunisia Company of Lubricants. Environ Toxicol Stud J Vol.3 No. 1:1

Copyright: © 2019 Amor LB, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Abstract

The present study intends to examine the links between industrial gross domestic product, skilled labor, invested capital and finished products for Tunisian Company of Lubricants on a temporal model over the 1980-2017 periods. Indeed, we demonstrate that the policy maker using capital and labor is essential to raise the industrial gross domestic product for this manufacturing sector by producing secondary materials and improving research activity. Our results imply that there is a great relationship among these variable, as a consequence of the benefits for re-refining used lube oil in economic growth of Tunisia. Finally, we find that our analytical framework is compliant with the empirical results.

Keywords

Oil lube refining; Economic growth; Temporal data model; JEL classification: Q32, B27, C23

Abbreviations

ECM: Error Correction Model; TCL: Tunisian Company of Lubricants; NEPA: National Environmental Protection Agency; NWMA: National Waste Management Agency; IDEA: Institute for Democracy and Electoral Assistance; VA: Value Added; PAI: Promotion Agency for Industry; NIS: National Institute of Statistics

GDP: Gross Domestic Product; ADF: Augmented Dickey-Fuller; KPSS: Kwiatkowski-Phillips- Schmidt-Shin; SFP: Secondary Finished Products; GETS: General-to-Specific; OLS: Ordinary Least Squares

Introduction

The Conference on Environment and Development which was held in Rio meeting in 1992 focused on the high risks of hazardous waste. These issues have become even more pressing worldwide. As a consequence, governments should urge waste minimization and increased recycling as strategies towards a sound waste treatment.

According to the 2015 Hazardous Waste Report, it must regulate the management of this category of waste in order to protect energy and other resources from discarded materials. The Waste hazardous management occurs internationally. Yet, the research in the developing countries like Africa and especially North Africa seems very scarce.

In order to analyze the impact of labor, capital and Secondary finished products on Industrial Gross Domestic Product pollution, we decided to develop an empirical study on Tunisian Company of Lubricants (TCL). Indeed, this company plays a central role in reducing waste generation and creating an employment through local action plans and policies via technical, institutional, policy and financial measures. Also, it is engines of economic growth and social change incorporating the determinant factors, which improve to increase the rate of regenerating for used lube oil in TCL [1]. Subsequently, it will be interesting to investigate the relation cited above on city scale. Empirically, the relation between Gross Domestic Product and economic indicators is not sufficiently studied at the empirical level. This paper proposes to make a contribution to the existing literature by examining the impact of principal factors on GDP for Company of Lubricants in Tunisia Country, which is the only establishment that regenerates the used lube oil during the 1980– 2017 period using econometric techniques. Specifically, we contribute to the literature in four ways. First, we build a very comprehensive data base of GDP, and Economical factors consisting on Tunisian Company of Lubricants over the period 1980–2017. Second, the use of economic factors which can be seen as new in the literature focused on the relation between GDP and factors relating recycling waste. Third, we use different factors which are also new; in most of the studies interested on environmental effects of refining used lube oil, the Secondary Finished Products (SFP) is used as proxy of output for Tunisian Company of Lubricants. Finally, we examine the dynamic relation among our endogenous series (GDP, labor and capital factors, also secondary finished products) using the approach of cointegration and the Error Correction Model (ECM) as methodology.

Hence, the present paper analyzes the relationship between economic growth and essential factors for recycling sector. There is a cointegration technique and causal relation in long and short - run by using the Error Correction Model (ECM).An interesting case study along this paper is Tunisia which has begun to pay greater attention to the environment-related norms like waste hazardous treatment, in part as consequence of its insertion into the world economy meeting certain environmental norms through building treatment centers on this category of waste.

In this sense, the hazardous waste such as the used lube oil represents a main advantage for the Tunisian Company of Lubricants (TCL) because it can be reinstated in the processes of production. In addition, it serves as a “secondary raw material” through the introduction of a new product on the market with a new feature. Thus, in this study we will look at the issues of used lube oil re-refining, energy saving and economic growth related to the Tunisian context.

The main objective of this paper is to examine the relationship between industrial gross domestic product, labor, capital and finished products on temporal model of Tunisian Company of Lubricants over 1980-2017 periods. We used an Error Correction Term (ECM) approach initiated by Engle and Granger [2]. We introduced the function of Cobb-Douglas production framework in order to determine the causal links between these variable disposed previously.

In the face of these incentives, we are prompted to pollute less, to sort out the hazardous waste and to treat it. In order to renew the life cycle of the waste, it consists in analyzing the valuation networks, in particular as the recycling sector, through the introduction of a new product on the market with a new feature.

Hence, for this research, we will be looking at these lines surrounding waste recycling, energy conservation, and economic development as they are related to the case of our country, Tunisia. In this study, we want to answer the following questions:

➢ What are the determinant factors that are responsible for the success of Industrial gross domestic produced covered by the Tunisian Company of Lubricants.

➢ How do these factors contribute to the development of this society.

➢ To what extent do these factors affect the economic growth in Tunisia and the production of this regeneration industry.

In order to answer these questions, we fixed an ideal framework to analyze this subject in both its scope and effectiveness. As consequently, we subdivided this study into four sections. The first gives an overview of the Tunisian Company of Lubricants for re-refining used lube oil in Tunisia. Section two presents the literature review. The third section provides the empirical model’s specification, the estimation technique; and the empirical analysis of the regression results. The conclusion and policy implications are introduced in the last section.

An Overview of Re-Refining used Lube Oil in Economy of Tunisia

Lubricating oils, like many consumer products have a short shelf life. Accordingly, they are found as hazardous waste. Faced with the wide geographic dispersion of the lubricating oil deposit, the multiplicity of oil owners and the dangers oil poses to the environment and to the health of individuals, the Tunisian legislature enacted, in April 2002, the 2002-693 Decree which establishes the conditions and procedures for recovering the lubricating oil and the used oil filters as well as their management.

Before the publication of this decree, many advances have been made in the management of waste oils since the creation of the Tunisian Company of Lubricants in 1979, which provides both the collection and regeneration of waste oils. Precisely, this establishment is only responsible at refining of used lube oil. The unit of used lube oil regeneration in the Tunisian Company of Lubricants has been working since 1980. It was originally designed by an acid-earth process. This method has been proved as unsatisfactory from an environmental point of view due to the accumulation of used oils and acid tar on the plant site, which could not be disposed of or processed. In this context, Guemara [3] indicated that the Tunisian Company of Lubricants has begun the research since the early 90s and has managed to develop a new technology for regenerating oils waste using a simpler technical configuration reconciling the environment with the economy.

In addition, the study of Bouaoun [4] implies that the waste management and recycling program for used lube oil in Tunisia deemed to be one of the most successful state-level programs in this country considering the local government investments and public participation.

Hence, Tunisia began a state-wide recycling effort in 1997 after the adoption of a legislation based on the NEPA (National Environmental Protection Agency) and NWMA (National Waste Management Agency) recommendations, under the supervision of the Ministry of Environment and Sustainable Development. The legislation provides state funding for waste reduction, recycling program management and household hazardous or domestic waste management.

The NWMA data base compiles data from annual surveys of waste management and recycling in all the country. The NWMA survey is administered by the Tunisian Pollution Control Agency and is completed by county solid waste officers.

The survey helps the researcher to collect information on generated Municipal Solid Waste (MSW), materials collected for recycling, a solid waste collection system, recycling programs and management, waste and recycling revenue and expenditure, source reduction programs and other MSW policy initiatives.

To be in compliance with the settled line of conduct, namely the environmental protection, the Tunisian Company of Lubricants leads at present a local follow-up study to confirm the already released conclusions related to the non-nuisance of the environment by using the bottom of the pipe of distillation as an additive for asphalt and to determine the instructions for using this product within the reach of all the contractors.

After the laboratory trials and the pioneering phase, this technology has been successfully tested in the existing facility, which has also undergone some changes by incorporating some new equipment. Since its creation, and in anticipation of the future, the Tunisian Company of Lubricants is dedicated to protecting the environment by tackling a waste which is considered to be very harmful due to the complexity of its constituents.

The Institute For Democracy and Electoral Assistance (IDEA) of Tunisia [5], shows that this society produces four qualities of fats under various NLGI ranks, meeting the requirements of its customers consisting essentially of multinational companies operating in the petroleum industry. These four qualities of fats are as follows:

➢ A calcic fat based on Calcium soap which suits in any lubrication in little bit harsh conditions.

➢ A multi-service fat based on soap made up of mixed Lithium / calcium or pure Lithium, which suits in greasing all the workings of machines in normal conditions of load and speed.

➢ A Superstabil EP fat based on complex Lithium soap, which benefits from the most recent technical developments in lubricating fats. It suits greasing almost all the machine workings in an interval of temperature between -20°C and +130°C.

➢ An Akron EP fat based on complex Lithium soap. It is particularly anticorrosive and of exceptional stable thanks to its high doping level. It is essentially adapted to the greasing of materials used in difficult conditions such as shocks, vibrations, corrosive atmosphere and strong loads.

In addition to manufacturing fats, the refining of the used lube oil brings out two products: The first one is used as an additive for asphalt without any nuisance on the environment, and the second one is assimilated into commercial diesel oil. The new process of regeneration provides no effluent harm to the environment. Taking 2001 as an example, 12 016 tons, out of collected 13054 tons, were treated producing 7024 tons of distillates.

Thus, the modern conditions of treatment, as they are practiced today, allow obtaining regenerated acceptable-quality oil, without environmental harmfulness. Indeed, this regeneration can take the way of new oil, like nowadays, or the form of an obligation for the producers of oil to incorporate a certain percentage of refining used lube oil. Hence, there is cooperation between the Tunisian Company of Lubricants and multinationals at the leading edge of innovation has greatly contributed to developing the enterprise spirit of research that has hitherto been directed towards the survival of the regeneration activity.

This cultural heritage has already yielded its fruit since the Tunisian Company of Lubricants could develop a new balancing method between the environmental and economic aspects and would be responsible for boosting the regeneration activity which has also undergone a total slackening internationally in the recent decades.

Thus, thanks to the expertise of its staff, the company has been able to control and treat problems related to collecting, storing and recycling waste oils. Therefore, the company has confirmed that regeneration is the most viable way because it happens at competitive prices for quality products designed mainly for the oil sector.

We show that re-refining of used lube oil, produced by TLC (Tunisian Company of Lubricants) is an economically attractive recycling method in terms of energy saving, environment protection, and economic prosperity.

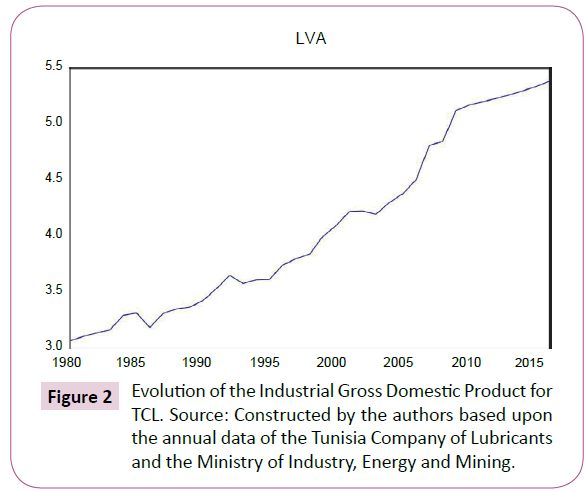

We notice (see the graphic below) that the added value given by this company is characterized by a very moderate rise during 1980-2000, a temporal stability during 2000- 2001, and a fast growth since 2003.This dynamic is mainly explained by the following factors:

➢ Amortization of production and collection equipment;

➢ The sale price of new lubricating oil has extremely developed. This development is linked to the increase in oil prices;

➢ Establishing a special levy (eco-tax) deducted from used lubricating oil in conditions corresponding to the rules related to environmental protection;

➢ The system of collection and treatment is in the phase of maturity (minimize losses and waste).

Accordingly, the implementation of eco-lubricants aims to confide to the oil producers the responsibility of collecting and eliminating the used lubricants, on the basis of a voluntary financing.

Source: Constructed by the authors based upon the annual data of the Tunisia Company of Lubricants and the Ministry of Industry, Energy and Mining.

Literature Review

In this section, we have treated the corresponding research studies on our subject. We have noted that the literature concerning a relation between waste recycling and economic growth has greatly developed by the neoclassical theorists within the framework of “endogenous growth”. In spite of agreement reached confirming the existence of the relationship between these two variables, the consensus in favor has already been discussed.

We have taken an empirical level including three cases examine the relationship between waste recycling and economic growth. The first case indicates that waste recycling has affected positively the economic growth in many countries. This scene was greatly justified through this empirical work concerning Tunisian, as developing country, in which Tunisian Company of Lubricants can be an effective process of refining used lube oil, creating job for unemployed people and providing economic prosperity as whole (Figures 1 and 2).

Not only Tunisia in which we have found the significant effect of waste recycling on economic growth, but also another developing countries like as China [6-9]. This is also applies to developed countries in the case of European Union and Unites States of America [10-18], concerning Canada. Besides, we have found some economic institutions [19-21], that has demonstrated the significant impact of waste recycling on growth rate.

The second view suggests that the two processes “economic growth and waste are recycling” have to go together and complement each other. Through the recycling, the waste is transformed into a finished product and could be considered in optimistic input on production function. As consequently, this object promotes the economic growth by selling it in the market. This idea was supported on the following studies [22-25]. It is greater to recycle, greater to produce secondary materials from waste and greater to increase the economic growth as whole Kamien et al. [26].

Hence et al. [27], have proved that this positive relationship has been sighted in industrialized nations also, for Jones and Williams, [28] and has continued to build on the years 2000 until now [29,30]. This panorama of waste recycling was inspired by developing countries like Tunisia since 1979 by creating for Tunisian Company of Lubricants, which is a most example for refining, used lube oil. Other developing nations that have adopted waste management to contribute their economic growth such as China (CIA), Mexico (Corral-Verdugo) [31,32].

Finally, the last vision indicates that there has been decoupling between waste recycling and economic growth. This examination has been observed by Mazzanti and Zaboli in the case of European Union, Wrap concerning England, Scotland, Wales and Northern Ireland, Seungtaek Lee et al. [33-35] regarding United States. Also, this observation has been analysed by Priya and Pavitra, in the case of India, Abdelkader and Olfa concerning Tunisia and Abdullahi et al., regarding Nigeria [36-38].

Econometric Methodology and Results

Data and description of variables

In this paper, we are interested only in the Tunisian Company of Lubricants because it constitutes the only unity responsible at the refining of used lube oil in Tunisia.

In this study, the data are collected from five different sources: The National Waste Management Agency (NWMA), The National Environmental Protection Agency (NEPA), and The Promotion Agency for Industry (PAI), The National Institute of Statistics (INS), and the Ministry of Industry, Energy, and Mining, data base in Tunisia. These variables are defined in the Table 1.

| Variable | Definition |

|---|---|

| GDP | The sum of added value for refining used lube oil of Tunisian Company of Lubricants (TLC) |

| K | The stock of capital used by this society |

| L | The quantity of labor used by this company |

| SFP | The secondary finished products |

Table 1: Definition of variables.

The development indicator chosen in this study is the industrial GDP specific to Tunisian Company of Lubricants. This indicator is calculated according to the sum of the value added by this company in millions of Tunisian dinars at current prices for the period between 1980 and 2017.

By highlighting the determinants of refined used lube oil, we will process the model which describes the sum of clear added value for refining used lube oil in function of capital, labor and secondary finished products.

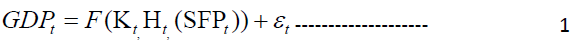

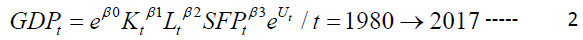

Based on these data, we have developed a temporal model with 37 observations and the linear econometric specification of the company’s refining used lube oil function is specified as follows:

Empirical methodology on temporal model

Temporal unit root tests: We define the temporal series that are a continuation of numerical values representing the evolution of a specific quantity in time. Such variables can be mathematically expressed to analyze the behavior, generally to understand its past evolution and to plan the future behavior. Such a mathematical transposition uses most of the time concepts of probability and statistics. The object of the temporal series is to study the evolution of variables in time. Its main objective is to represent the determination of trends within these series as well as the stability of the values and their variation in time.

Generally, to estimate our model we begin our analysis with the implementation of the temporal unit root tests such as ADF and KPSS, to check the instability of the variables in our model. Yet, we noticed that the gross domestic product is not stable just as the possible explanatory variables, which are the stocks of capital and labor (see the Table 2 below). This leads to utilizing the econometrics of the unstable variables.

| Tests | ADF in level form | ADF in first difference | KPSS in level | KPSS in first difference |

|---|---|---|---|---|

| GDP (Gross Domestic Product) | 2.31 | - 4.55 | 0.65 | 0.25 |

| K (Stock of Capital) | 0.06 | - 3.56 | 0.64 | 0.05 |

| L (Quantity of Labor) | - 0.57 | - 1.25 | 0.66 | 0.28 |

| SFP (Secondary Finished Products) | - 0.85 | - 5.54 | 0.75 | 0.17 |

Table 2: ADF and KPSS Tests.

Econometric Modeling and Main Results

To facilitate the estimation of this empirical part in which we would to determine the relationship between the industrial gross domestic product and the explanatory variables (labor, capital and secondary products), we could use the Cobb-Douglas production function introducing labor and capital as the main factors of production. In addition, this function is called “Cobb-Douglas” which established the relationship between the production and the contribution of capital (K) both labor (L), also the secondary finished products. In this context, we prove that this function was appeared on the neoclassical endogenous growth model which considered the waste of recycling have been optimistic variable. Indeed, this input could increase the function of production [39].

More recently, Abdouli and Hammami [40], included energy in their empirical model to determine the effect of this variable on economic growth. As result, they found that this factor contribute the growth rate in Tunisia.

In this present research, we are on roughly the same axis about energy. We are interested to explain the dynamics of the industrial gross domestic product brought up by Tunisian Company of Lubricants within the framework of energy conservation et not consumption. Thus, we begin by specifying the theoretical model. Based on the neo-classic optics, we can write the following specification:

While referring to the theoretical base of production function, the exhibitors ( β1, β2, β3 ) that have affected the explanatory variables (K,L,SFP), are the elasticity of production relative to these variables and their sum is equal to 1. And, "e" represents the dimensional coefficient that depends on used units of measurement.

As consequently, we try to demonstrate how the used lube oil refining as input effects the chronological dynamic with the main factors as capital and labor affect the industrial gross domestic product as output of Tunisian Company of Lubricants.

Highlighting this idea, we utilized the academic and rigorous method Error Correction Term (ECM) testing approach to examine the long and short-run co integration relationship between the two proxies of industrial gross domestic product and labor, capital and finished products considered as the principal factors of production function. The ECM modeling methodology originally was developed by Granger [41] and later expanded upon by Engle [2]. The ECM approach allows to avoiding the problem of “fallacious regression” in comparison to other methods.

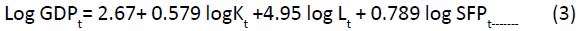

Hence, the application of the procedure of Engle and Granger [2], in first step, has allowed us to bring out the following long-term relation:

Based on this above relationship, we have concluded that the residues released are stable, which allows us to assign about a long-term relation of the added value emerged from Tunisian Company of Lubricants.

Economically, the obtained results seem to be in agreement with the economic logic because the long-term elasticity of labor is clearly more important than that of capital. The long-term elasticity of the EM is very important, which indicates that the refining of used lube oil in secondary products and their sale strongly influence the added value of this society.

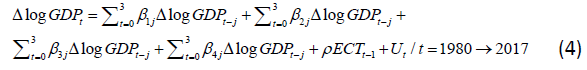

In second step, the theorem of the representation of Engle and Granger establishes equivalence between the existence of a longterm relation and a correction-error model. Thus, we can specify the following short- run relation in which the Error Correction Model (ECM) of the Industrial gross domestic product of Tunisian Company of Lubricants:

Where lGDP is the log of industrial GDP, ℰt is the white noise error term, and Δ is the first difference operator. The industrial GDP was collected from the Promotion Industry of Tunis and the National Institute of Statistics of Tunis. This indicator was calculated from the sum of added value for extracting and rerefining Petrol and Gas industry in millions of Tunisian dinars at current prices for the period between 1980 and 2017. Also, with reference to the Ministry of Industry, Energy and Mining, the added value for re-refining used lube oil covered by Tunisian company of Lubricants represents 0.5% of added value for sector of gas extraction and oil refining.

The explanatory variables are labor (L), capital (K) and secondary materials (EM). These indicators are collected from the Tunisian Company of Lubricants and the Promotion Industry of Tunis for the same period (1980-2017). The Tunisian Company of Lubricants (TCL) is included in the sector of extracting and refining petrol. In addition, the non-manufacturing subsectors which are considered in Tunisia are: Mine, Petroleum and Gas Extraction and Refining, Electricity Production, Water Production, Building and Civil Engineering.

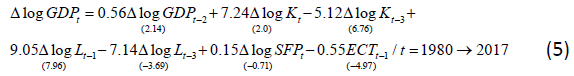

In the last step of estimation, we have applied the GETS procedure of Hendry [42-47] and the estimation of the equation above by OLS has given us the following econometric result:

The estimation of the equation of the Gross Domestic Product (GDP) in first difference reveals short-run and long-run effects. The short-term elasticity of the GDP compared to the stock of capital is (2.12=7.24-5.12) higher than the long-term one (0.579), which is not the case for the stock of labor where the short-term elasticity (2.91=9.05-7.14) is lower than the long- term one (4.95). Also, in a short period the elasticity of the GDP with respect to the secondary finished products is weaker than in a long period. What is interesting to interpret is the speed of adjustment or the recalling force in the equilibrium of the variations of the added value total of Tunisian Company of Lubricants.

On average, these variations are corrected with a 55% rate. Econometrically, the short-term elasticity is statistically significant with the exception of that affected by the variable of secondary finished products.

Finally, we found that the value of Durbin and Watson indicates the non-existence of an auto-correlation problem, which enables concluding the efficiency of estimators.

Conclusion and Policy Implications

In this study, we examined the links between industrial gross domestic product, labor and capital for Tunisian Company of Lubricants which is responsible at refining of used lube oil and derived some implications. The operational relationship analyzed previously is effective for synthetic explicating the long and short-run dependent relationship between used lube oil refining and gross domestic product. This explanation based on the implications will assign it more precise this functional relationship between the main factors for production as capital both labor and used lube generated.

The main findings showed that the re-refined used lube oil raises the income of the TCL (Tunisian Company of Lubricants) considered, given an example of a parameter configuration in which the GDP (Gross Domestic Product) for this industry raises especially as secondary materials which are considered. Hence, our model predicts that the TCL augment used lube oil was refining to improve his income in particular, and welfare of Tunisia, in general, by producing and selling secondary materials to several markets. Indeed, we can affirm that the greater is the existence of labor and capital, as two principal factors, devoted to oil recycling, the lower is the dynamics of used lube oil accumulation and the greater will be a number of secondary materials produced. Concluding, re-refining can be an effective tool in the TCL for reducing waste generation, creating job and promoting economic growth of Tunisia. Hence, policy makers must consider the importance of the recycling sector and must give priority to the different process of the oil lube recycling as it has a significant impact on the value added improving in the TCL and can lead to more sustainable development for both of the manufacturing industrial sector and Tunisia as a whole.

From this perspective, the integration of the re-refined lube oil in the production process will need a complementary collaboration between R&D and technology, which requires a dynamic vision of the TCL in the future research activity. Further issues will be the estimation of our model with the data that will contain the “Technology Stock” as a new variable. In fact, as we show, the available technology of oil recycling will reduce the use of exhaustible resources.

Acknowledgement

A former draft of this paper has been accepted for oral presentation at the 3rd international Conference: Entrepreneurship, Innovative Territory, and Sustainable Development, held in Lille 1, France, on 30 Jun 2017. Thanks to Professors Abdelkader Djeflat, Corinne Cretaz and all researchers in Laboratory Clersé (University of Lille 1, France) for their useful suggestions an comments. All errors are the author’s alone.

Author’s Contributions

All authors contributed equally to this work. Lamia Ben AMOR wrote the main paper and Sami Hammami wrote the supplementary information. They discussed the results and implications and commented on the manuscript at all stages. All authors contributed extensively to the work presented in this paper.

Competing Interests

I declare that I have no significant competing financial, professional or personal interests that might have influenced the performance or presentation of the work described in this manuscript.

Information provide by authors will remain confidential during the review process and will be published with the article.

References

- Lamia BA, Sami H (2017) The Determinant Factors for the Rate of Recycling: The Example of UsedLube Oils in Tunisia. Int J Waste Res 7: 1-6.

- Engle RF, Granger CWJ (1987) Cointegration and Correction: Representation, Estimation, and Testing. Econometrica 55: 251-276.

- Guemara J (1998) Extension of the activities of the unit for the treatment of oil filters and its impact on the determination of an ecotax specific.

- Bouaoun M (2014) The Regional Network of Exchange of Information and Expertise in the Solid Waste Sector in Maghreb and Mashreq.

- IDEA (Institute for Democracy and Electoral Assistance) (2002) Issues of clusters of oils and used filters in Tunis, Tunisia.

- Li S (2003) The Case of Metropolitan Wuhan. Environ Behav 35: 784-801.

- Bernache G, Sanchez S, Garmendia AM, Davila A (2001) Solid waste characterization study in the Guadalajara Metropolitan Zone Mexico. Waste Manag Res 19: 413-424.

- Wells C (1994) The Brazilian Recycling Commitment: helping stimulate a recycling in developing country Industry and Environment 17: 14-17.

- Metin E, Erozturk A, Neyim C (2003) Solid waste management practices and review of recovery and recycling operations in Turkey. Waste Manage Pp: 425-432.

- Daskalopoulos E, Badr O, Probert SD (1998) Municipal solid waste: a prediction methodology for the generation rate and composition in the European Union countries and the United States of America 24: 155-166.

- Taylor DC (2000) Policy incentives to minimize generation of municipal solid waste. Waste Manage Res 18: 406-419.

- Shinkuma T (2003) On the Second-Best Policy of Household’s Waste Recycling. Environ Res Econ 24: 77-95.

- Vita D, Giuseppe (2001) Technological Change, Growth and Waste Recycling. Energy Econ 23: 549-567.

- Vita D, Giuseppe (2001) Exhaustible Resources and Secondary Materials: A Macroeconomic Analysis.

- Consultant Plus (2015) Federal law of Russian Federation from 24.06.1998 89. On production and consumption waste.

- Adoue C, Beulque R, Carre L, Couteau J (2014) A circular economy, engine of growth? Begin The Circular Economy.

- What Business Strategies for Transition of Tomorrow (Institute of Agency of Environment and Energy Management (2016) Extended Producer Responsibity (ADEME).

- Zhu Guohong (1995) Relations between the people. J Pop Eco 88: 18-24.

- EPA (Environmental Protection Agency United States) (2016) Advancing Sustainable Management Recycling Economic Information (REI) Report October 2016.

- OCDE (1995) Recycling of Copper, Lead and Zinc Bearing Wastes. Environ Monographs n° 109, Paris.

- World Trade Organization (1999) Trade and Environment Geneva WTO Publication.

- Romer PM (1990) Endogenous technological change. J Polit Econ 98: 71-102.

- Baumol WJ (1977) on recycling as a moot environmental issue. J Environ Econ Manage 4: 83-87.

- Hoel M (1978) Resource extraction and recycling with environmental costs. J Environ Econ Manage 5: 220-235.

- Smith VL (1972) Dynamics of waste accumulation: disposal versus recycling. Q J Econ 36: 600-616.

- Kamien MI, Schwartz NL (1978) optimal exhaustible resource depletion and endogenous technical change. Rev Econ Stud 45: 179-196.

- Barro RJ, Sala IM (1995) Economic Growth. McGraw-Hill, New York.

- Jones CI, Williams JC (1999) Too Much of a Good Thing? The Economics of Investment in R & D. NBER Working Paper Series 7283: 1-28.

- Eurostat (2003) Theme 8 Environment and Energy, European Commission, Cat. No. KS- 55-03-471-EN-N.

- Kelly TC, Mason IG, Leiss MW, Ganesh S (2005) University community responses to on-campus resource recycling. Res Cons Rec.

- CIA (2004) The World Factbook, United States Central Intelligence Agency.

- Corral V (1997) Dual Realities’ of Conservation Behavior: Self-Reports vs. Observations of Re-use and Recycling Behavior. J Environ Psycho 17: 135-145.

- Mazzanti M, Zoboli R (2008) Waste generation, waste disposal and policy effectiveness: Evidence on decoupling from the European Union. Res Cons Rec 52: 1221-1234.

- Wrap (2012) Decoupling waste and economic indicators www.wrap.org.uk.

- Seungtaek L, Jonghoon K, Wai O (2016) The causes of the municipal solid waste and the greenhouse gas emissions from the waste sector in the United States. International Conference on Sustainable Design, Engineering and Construction Procedia Engineering 145: 1074-1079.

- Priya G, Pavitra S (2014) an Analytical Study of Effect of Family Income and Size on Per Capita Household Solid Waste Generation in Developing Countries. Rev Arts Humanities 3: 2334-2935.

- Abedlkader D, Olfa T (2014) The management of industrial waste by recycling in Tunisia. Int J Inno Sci Res 7: 140-154.

- Abdullahi I, Ajibike MA, Man AP, Ndububa OI (2014) Environmental Impact of Indiscriminate Waste Disposal A Case study of Nigerian Air force Base Kaduna. Int J Eng Appl Sci.

- Stiglitz JE (1974) Growth with exhaustible natural resources: efficient and optimal growth paths. Rev Econ Stud 41: 123-137.

- Abdouli M, Sami H (2017) Exploring links between FDI Inflows, Energy Consumption, and Economic Growth: Further Evidence from MENA Countries. J Dev Econ 42: 95-117.

- Granger C (1981) Some Properties of Time Series Data and Their Use in Econometric Model Specification. J Econ 16: 121-130.

- Hendry DF (1995a) Dynamic Econometrics, Oxford University Press Oxford.

- Dickey D, Fuller W (1981) Likelihood Ratio Statistics for Autoregressive Time Series with a Unit Root. Economet 49: 1057-1072.

- Douglas P (1976) The Cobb-Douglas production function one again: its history, its testing’s and some empirical values. J Polit Econ 903-915.

- EPA (Environmental Protection Agency United States) (2015) Hazardous Waste Report, Instructions and Form, Office of Resource Conservation and Recovery (ORCR) (5303P) Washington, DC 20460.

- GTZ, Bouaoun M (2014) Country profile on solid waste management in Tunisia. Report on Solid Waste Management in Tunisia, German Cooperation, GTZ and SWEEPNET.

- Kwiatkowski D, Phillips PCB, Schmidt P, ShinY (1992) Testing the null hypothesis of stationarity against the alternative of a unit root: How sure are we that economic time series have a unit root. J Econ 54: 159-178.

Open Access Journals

- Aquaculture & Veterinary Science

- Chemistry & Chemical Sciences

- Clinical Sciences

- Engineering

- General Science

- Genetics & Molecular Biology

- Health Care & Nursing

- Immunology & Microbiology

- Materials Science

- Mathematics & Physics

- Medical Sciences

- Neurology & Psychiatry

- Oncology & Cancer Science

- Pharmaceutical Sciences